The UK’s Public Debt: Tax Increases, Economic Strain, and the Flight of High-Net-Worth Individuals

The UK’s public debt, now exceeding £2.8 trillion, is placing increasing strain on the economy through higher taxes, slower

The UK’s public debt, now exceeding £2.8 trillion, is placing increasing strain on the economy through higher taxes, slower growth, and declining investor confidence. Prominent investor Ray Dalio has described the situation as a “doom loop,” warning that Britain faces difficult policy choices including spending cuts and further tax rises. The UK’s government debt now exceeds £2.8 trillion, with £110 billion in interest payments due. The UK deficit was recorded at 5.7% of GDP at the end of 2024.

While the UK’s public debt is making people and millionaires run away from the country, the government has no solution. Meanwhile, Rachel Reeves considers tax rises in her autumn budget.

Financial Pressure: Dark Days for the UK

One of the world’s most prominent hedge fund investors, Ray Dalio, has warned that the UK is stuck in a “doom loop“. The UK faces a worrying mix of higher taxes, rising debts, and slower growth. Ray Dalio warns about public finances, saying Britain will be forced into spending cuts and tax rises.

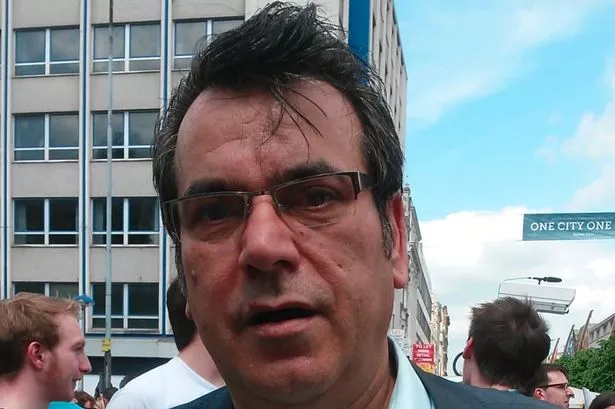

Dalio, a US billionaire who founded the hedge fund Bridgewater Associates in 1975, warned about debts. He said warning signs about debt levels in Western countries were beginning to flash and flicker. However, the UK government’s efforts to raise more funds via taxes risked driving its wealthiest taxpayers out of the country.

The UK’s Public Debt: More Warnings for Worse Conditions

The hedge fund founder told the Master Investor podcast with Wilfred Frost that the debt doom loop is also affecting capital flows. He said the need to increase taxes was driving people away. They move for their capital reasons. Dalio argued that debt-laden countries like Britain will need tax rises and spending cuts to regain control of their finances. UK government debt now exceeds £2.8 trillion, with £110 billion in interest payments due this year. He also cautioned that AI stocks may be overpriced. He noted that even optimistic forecasts might not justify the valuations of companies such as Nvidia and Apple.

Dalio said that there is a deterioration in conditions, as financial and social problems worsen. It is causing wealthy individuals to leave. That is a problem because the top 10% pay 75% of income taxes. Therefore, if a country loses 5% of the population in that category, it loses 35% or more of the tax revenue.

UK Deficit in GDP: Who Pays the Price

The UK deficit was about 5.7% of GDP at the end of 2024, according to the Office for Budget Responsibility (OBR). It is four percentage points higher than the average advanced economy and the third highest among 28 advanced European economies. The Office for National Statistics (ONS) said June borrowing rose to £20.7 billion last month. It is £6.6 billion higher than a year earlier and the second-highest June borrowing since records began.

Meanwhile, new figures showed that the number of UK businesses in critical financial distress had jumped to 49,309 in the second quarter of this year. It is an 8.6% rise compared to the first three months of 2025. The insolvency experts Begbies Traynor said businesses were struggling because of worrying, volatile consumer spending and rising taxes on business.

Borrowing Problem of the UK: No Solution

There is a challenge that Britain’s political class seems incapable of rising to. Since the pandemic, UK public borrowing has been on a sharp upward trajectory. By the end of last year, the national debt approached 100% of GDP, and the fiscal deficit was over 5%. The Office for Budget Responsibility warns that the public debt will reach 270% of annual output over the next 50 years. The Labour government’s proposal to cut winter fuel payments to wealthier retirees was not effective. It ran into fierce opposition from the party’s lawmakers. Last month, the state borrowed a further 21 billion pounds, its highest ever monthly net borrowing. It is 3.6 billion pounds higher than the OBR had predicted.

Britain is hardly an outlier among the large, developed economies. France’s public debt is even higher at 112% of GDP, and last year’s budget deficit was 5.7% of economic output. Governments could raise taxes, cut spending, and take decisive action to boost economic growth. If they took these strict measures, pesky fiscal deficits would gradually evaporate.

Reeves’ Decision Worsens the UK’s Public Debt

While the UK’s public debt is making people and millionaires run away from the country, the government has no solution. The warning comes as the chancellor, Rachel Reeves, considers tax rises in her autumn budget. There is a growing speculation that she could target some of the wealthiest people in the UK. She wants to avoid putting further pressure on consumers.

But some wealth experts have warned that this could compound the effects of the abolition of the “non-doom” regime. The former Conservative government and the current Labour cabinet triggered the situation. Those changes ended the arrangements that allowed wealthy foreign people to avoid paying tax on money they were earning outside the UK. They also avoided paying inheritance tax on their global assets.

The UK’s Public Debt: Millionaires are Running Away

The UK will suffer the largest outflow of millionaires globally in 2025, according to data from Henley & Partners. It is making a bleak reversal for a country that was a magnet for global wealth. The Henley Private Wealth Migration Report 2025 forecasts a net loss of 16,500 high-net-worth individuals (HNWIs) from the UK this year. As many as 9,500 people with at least $1 million in liquid, investable assets, will leave the country.

The UK will lose 16,500 millionaires in 2025, more than any other country on record.

Tax hikes and declining economic confidence are driving the rich away, according to Henley & Partners. The country is now uniquely in the global migration landscape. It is losing on both sides of the ledger, with limited accessible pathways for inbound investor migrants, while simultaneously experiencing record-breaking millionaire outflows.