Rising Food Prices in Britain: The Third Fastest Monthly Rate in a Year

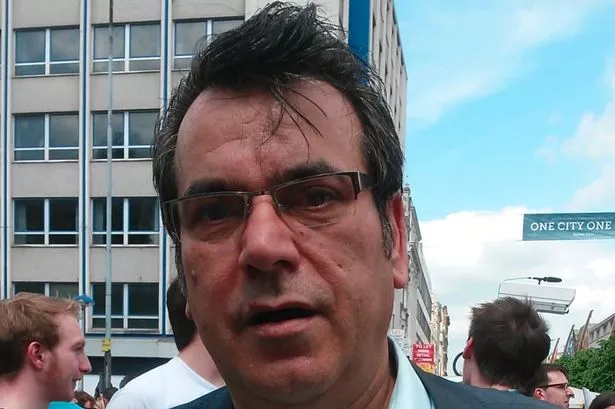

James Tweedi, writer and political commentator, sheds light on the complex factors driving the recent surge in food prices

James Tweedi, writer and political commentator, sheds light on the complex factors driving the recent surge in food prices across the UK. From pandemic disruptions and geopolitical sanctions to government policies and regulatory challenges, Tweedi unpacks how these forces combine to strain households and businesses alike. This analysis explores the real impact behind the headlines and what needs to change to restore affordability and resilience in Britain’s food sector.

1. What are the primary supply-side factors, including weather and import dependency, contributing to the recent sharp increases in staple food prices like butter and dairy in the UK?

The rise in food prices isn’t a recent phenomenon. It began during the COVID-19 pandemic, when large parts of the economy were shut down and people stayed home. However, prices surged dramatically after the war in Ukraine. The UK government imposed sanctions and embargoes on Russian imports, many of which were critical to food production—such as wheat, agricultural fertilisers, and the fuel required to produce, store, and transport food. These disruptions in supply chains and input costs have significantly driven up prices of staples like butter and dairy.

2. How effective is the UK Government’s suspension of import tariffs on 89 food and drink products likely to be in mitigating inflationary pressures on consumer food prices in both the short and long term?

The UK government cut tariffs on certain imported food and drink products in April. However, this move had little visible impact on supermarket prices and failed to make headlines. From a consumer perspective, it went largely unnoticed, suggesting that the suspension has had minimal effect on easing inflationary pressures so far. Whether it has long-term impact depends on broader trade dynamics and energy costs, but early signs are not promising.

3. What are the implications of the UK potentially aligning with EU regulations on fresh meat and dairy products, including ECJ oversight, for domestic food production, trade, and regulatory autonomy?

Aligning with EU food regulations and accepting oversight from institutions like the European Court of Justice would reintroduce costly bureaucracy and compliance burdens. Such red tape historically inflated consumer prices—seen clearly in countries like Ireland after joining the euro. Remaining outside EU regulatory structures preserves the UK’s ability to shape food policy in a way that prioritizes domestic producers and keeps costs down.

4. How are supply chain disruptions and rising operating costs expected to impact the resilience and financial viability of mid-sized food businesses in the UK throughout 2025?

Rising food prices have placed mid-sized businesses under severe pressure. While food was once relatively cheap compared to wages and benefits, staples like bread and milk have nearly doubled in price since 2020. These increases are largely attributed to supply chain disruptions, sanctions, and higher input costs. Mid-sized businesses, especially in food retail and hospitality, face a tough operating environment in 2025 as they struggle to balance rising costs with consumer affordability.

5. In light of the rising food prices and cost of living crisis, what targeted policy interventions could better support low-income households and reduce the increasing demand on food banks across the UK?

The government should remove all international sanctions that are driving up costs, cut VAT on essential goods, and eliminate alcohol duty for licensed premises like pubs and restaurants. These interventions would directly reduce household expenses. Rather than expanding food bank reliance, policy should focus on restoring affordability across essentials to support independence and dignity for low-income households.

6. Given the ongoing inflationary pressures and low business confidence in the UK food and drink sector, what strategic actions should government and industry stakeholders prioritize to foster innovation, skills development, and export growth?

To rebuild confidence and support growth, the government must reduce economic burdens on businesses and consumers alike. This includes ending sanctions that distort markets, cutting VAT, and easing duties on key goods and services. These actions would create a more favourable environment for investment, innovation, and skills development while helping the UK food and drink sector regain its competitive edge both domestically and internationally.