Labour Government Tax Policies on Agriculture: Impact on Farmers and Food Security

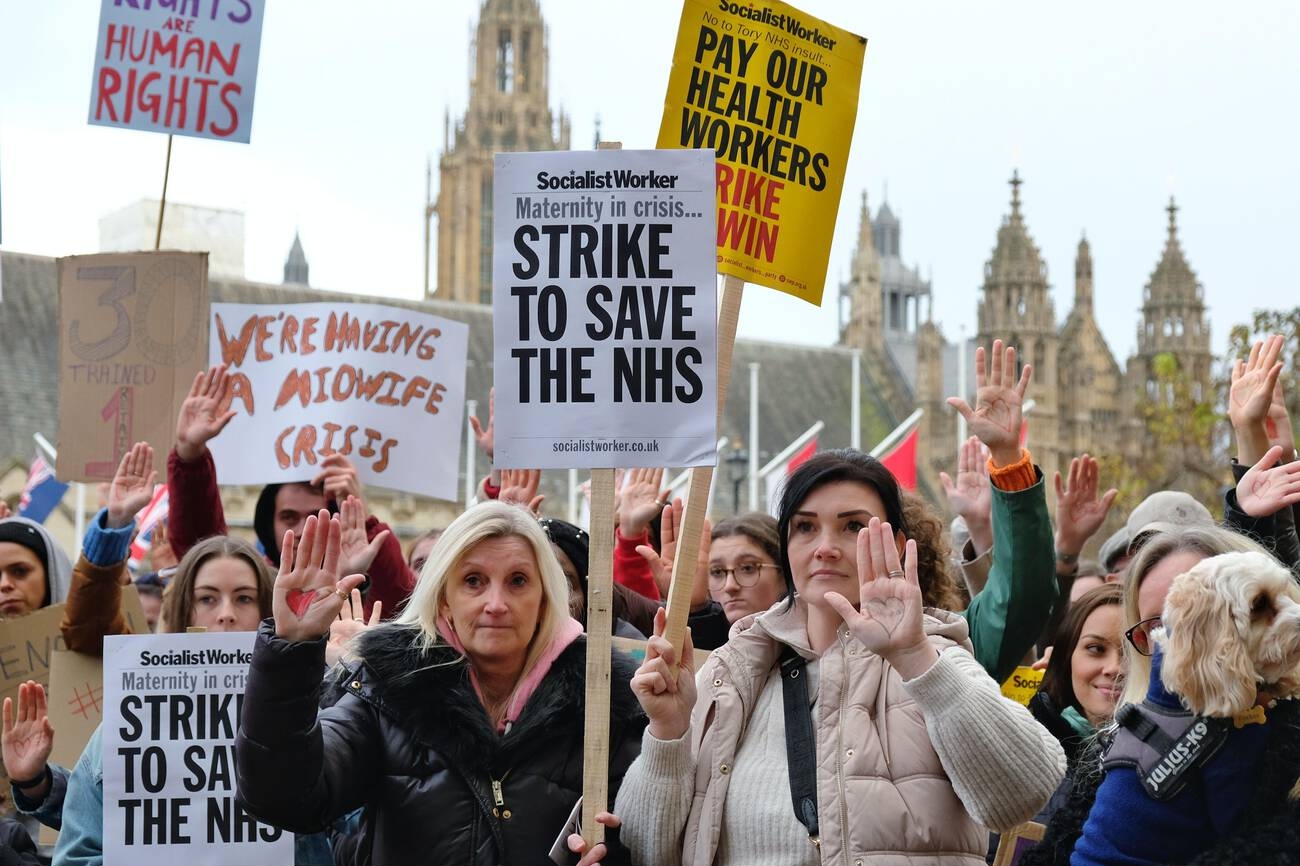

Thousands of UK farmers have gathered outside Parliament to protest against the government’s decision. Labour government tax policies on

Thousands of UK farmers have gathered outside Parliament to protest against the government’s decision. Labour government tax policies on agriculture lead to an increase in inheritance tax in its latest budget. The decision would end a tax break dating from the 1990s that exempts agricultural property from the levy. This means that from April 2026, farms worth more than £1 million (€1,197 million) will face a 20% tax when the owner dies and they are passed on to the next generation.

British farmers say such a hike will deal a ‘hammer blow’ to family farms struggling with climate change’s impact and global instability. The Brexit also caused upheaval. The UK’s Labour government says the “vast majority” of farms – about 75% – will not have to pay inheritance tax, and various loopholes mean that a farming couple can pass on an estate worth up to £3 million (€3,591 million) to their children tax-free. The 20% levy is half the 40% inheritance tax paid on other land and property in the UK.

Angry at the inheritance tax changes announced last month by the Chancellor of the Exchequer, Rachel Reeves, decided on inheritance tax.

Protesters carried placards reading “No farmers, no food” while a procession of tractors drove past Parliament. The change under Ms Reeves’s plan applies to people who inherit more than a million pounds of agricultural assets, about $1.3 million. They were previously exempt from inheritance tax. It will have to pay 20 per cent — half the standard rate — from April 2026.

More than two decades later, many farmers feel they lost out after Brexit. EU membership made farmers eligible for a generous system of agricultural subsidies. Many think that the replacement system that Britain is gradually introducing leaves them worse off. At the same time, the cost of exporting agricultural goods to Europe from Britain has risen, while supermarket chains have squeezed margins at home.

Around 60% of the food consumed in the UK is produced in the country.

The UK produces most of the cereals, meat, dairy, and eggs that it consumes. The percentages are lower for fruit (17%) and vegetables (55%) due to climate, seasonality, and consumer choice. The Department for Environment, Food and Rural Affairs (Defra) has assessed the UK’s food supply as “broadly stable”. Domestic food production is vulnerable to a range of factors. It includes:

- climate changes and extreme weather events; for example, flooding has impacted crops this year

- prices of agricultural goods

- high energy costs

- international supply chains; for example, fertilizer became more expensive following Russia’s invasion of Ukraine

- labour shortages

- biodiversity, soil, and water quality

- biosecurity and animal health

From April 2026, inheritance tax relief for businesses and agricultural assets would be capped at £1mn, with a new reduced rate of 20% being charged above that (rather than the standard inheritance tax rate of 40%). The tax would be payable in instalments over 10 years, interest-free. Labour government tax policies on agriculture could affect food security in the UK.

The Treasury has set out that full exemptions for transfers between spouses and civil partners would continue to apply.

There are also nil rate bands for inheritance tax, which people would retain access to on top of the £1mn. A nil rate band is an amount of an estate that can be passed on free of inheritance tax. The tax-free allowance for residences is £175,000 per person. Each person also has a £325,000 tax-free allowance that can be applied to all types of assets.

The government has confirmed that the valuation of an estate would include non-residential agricultural buildings, farm vehicles, farm tools, livestock, chemicals, and fertilizer stock. In August 2024, the government announced a “new deal for farmers” to “restore stability and confidence in the sector.” It said the measures would include:

- optimizing environmental land management schemes

- seeking a new veterinary agreement with the European Union to reduce “red tape at our borders” and enable more food exports

- protecting farmers from low welfare and low standards in trade deals

- Buying British produce when catering is government-funded, for example, in schools and the military

- gathering a new British infrastructure council to steer private investment in rural areas, including broadband rollout in our rural communities

- accelerating the building of flood defences and natural flood management schemes, including through a new flood resilience task force

- Introducing a land-use framework that balances long-term food security and nature recovery

The most dramatic reform leads to the Labour government’s tax policies on agriculture.

Repurposing England’s agricultural policy is a developed country’s most dramatic agricultural reform since New Zealand undertook its reform in the 1980s. The circumstances are very different. New Zealand eliminated its agricultural subsidies in response to a deep foreign exchange crisis that had seen the New Zealand dollar devalue by 55% against the US dollar in the previous ten years. England has maintained its financial support to agriculture (in nominal terms) but is redirecting it. Labour government tax policies on agriculture are a prominent sight of it.

Evaluating the early impacts of the agricultural transition in England is incredibly complicated by the volatility of input and output prices and farm incomes over 2020-2023. This volatility has two consequences. First, it makes it difficult to separate the impact on income at the national or farm level from the changes in market conditions and subsidy policy. Second, the volatility made it difficult for farmers to evaluate the ‘opportunity cost’ of participating in voluntary agri-environment schemes. Also, despite the price volatility, incomes from agricultural production were very buoyant over the period. This may have discouraged farmers from applying to join the agri-environment schemes despite the progressive reduction in direct payments.

Starmer pledges about farming.

The UK’s new centre-left government has pledged to champion British farming and prioritize food security, but questions linger over Labour’s plans for the country’s post-Brexit farming policies. Labour has pledged to increase food security and boost the UK’s agriculture sector with a “new deal for farmers.” It includes a goal that at least half of the food used in hospitals, schools, and prisons is British.

Of the five elements in the farming plan, all have been proposed by Labour. In addition to the target for British food in public institutions and the EU deal, the others are to bring farmers cheaper power through GB Energy, a publicly owned clean power company; help farmers put surplus renewable energy they generate into the grid; and create a flood resilience taskforce. Labour government tax policies on agriculture demonstrate a big gap between farmers and the government.